"On-the-trip". A turnaround strategy

for Trip Advisor

1. Executive Summary

This work takes the perspective of TripAdvisor (as of Q4-2017), first analysing the current state of the industry, competitors, and TripAdvisor` current business model. Key strengths, opportunities, weaknesses and threats are outlined, concluding with key reasons why TripAdvisor needs a strategic turnaround.

Consequently, the idea of TripAdvisor focusing on the “on-the-trip” part of the traveller journey is introduced, with a three-sided, B2B/B2C value proposition for travellers, hotels and device manufacturers. The customer need to-be-addressed, strategic fit to TripAdvisor`s assets and capabilities, as well as key components of the proposed technology offer and business model are presented, and a risk analysis is conducted.

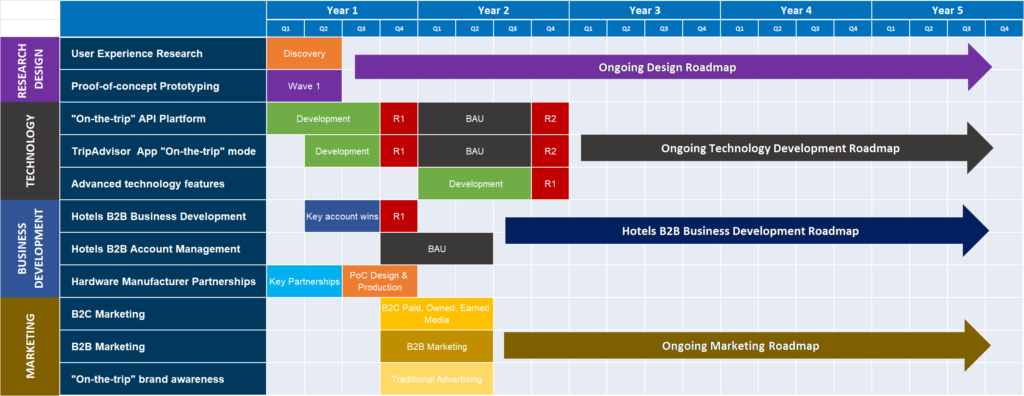

Finally, an execution roadmap is presented to demonstrate the necessary steps to implement “on-the-trip”, concluding that this strategy has the potential to re-inspire investors and re-shape TripAdvisor`s future.

2. Introduction to TripAdvisor

TripAdvisor was launched as a travel website in 2000, the start of a fascinating growth story . After raising $4.2m in venture capital , TripAdvisor was sold to IAC/Expedia for $210m in 2004 . Following 7 years of explosive growth Expedia decided to spin-off TripAdvisor in 2011, with a $4 billion IPO, exceeding Expedia’s own $3.8b market cap at the time. TripAdvisor reached a peak $15.5b market cap in 2014 (see Appendix, Graph 1).

Graph 1, Decrease in TripAdvisor market cap, from $15.5b in June 2014 to $4.8b in December 2017,

Source: macrotrends.net

Since 2014 however, even though continuing to grow listings traffic and customer reviews , TripAdvisor has gradually lost over two-thirds of its market value, down to $4.8b in December 2017 (see Appendix, Graph 1), reporting slow revenue growth , underperforming top peers and competitors in key performance ratios (see Appendix, Graph 2). TripAdvisor aggregates millions of travelers’ reviews, providing a platform that enables users to “research and plan their travel experiences”.

Graph 2, Bench-marking of key investment ratios, TripAdvisor viz-a-viz Industry peers, Source: morningstar.com

Since 2015, TripAdvisor also offers travelers availability-check, price-comparison, as well as booking, either directly in TripAdvisor or via partners. Apart from the TripAdvisor Website and App, the company also operates 23 other travel media brands , covering a wide-spectrum of online services for travelers.

3. A brief analysis of the online travel industry

The industry TripAdvisor is primarily operating in, can be defined as “online travel”, including bookings for hotels, travel, restaurant and other traveler activities. As travelers are increasingly pursuing omnichannel experiences across sectors , the dichotomy between offline and online is becoming obsolete, evolving the travel industry in a converged, interconnected platform business.

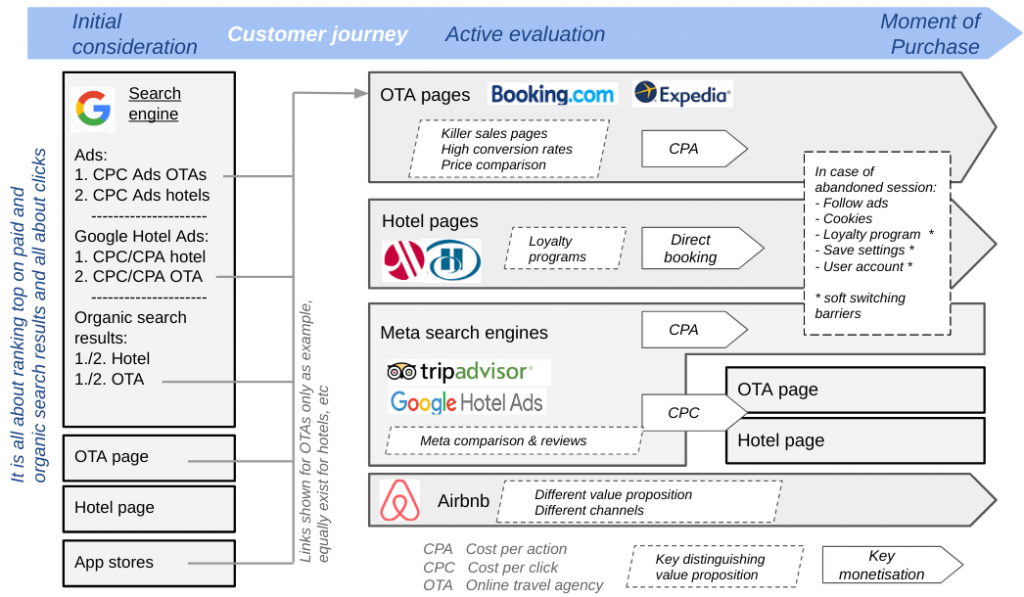

Internet industry giants have aggressively entered the travel industry, aiming at owning the full customer life-cycle, centred around booking transactions, which are considered the most high-value part of the value chain . Thus, as shown in the flowchart below, the lines are blurring in the hotels booking segment, as competition is increasing across the board.

Since 2013, the landscape has been constantly changing, with more competitors introducing new offers and services, in every step of the customer journey.

Flowchart 1, Converging customer life-cycle phases in the hotel segment of the tourism industry, Source: mirai.com

Google introduced experiences in every customer touchpoint, gradually transforming search engine results pages (SERPS), incorporating new modules such as maps, local, images to travel-related queries, also introducing new services: instant booking, comparison, trips, destinations, at the detriment of traditional organic results, on which incumbent competitors, notably TripAdvisor, are dependent for traffic and revenue.

In addition to building loyalty and end-to-end search/book/review experiences, Booking.com introduced an aggressive “best-price guarantee” service to eliminate the need for travelers to bounce to competitor sites to verify prices.

Trivago changed the focus of its advertising from “Trivago for the best price” in 2011 to “Hotel? Trivago” in 2015 , to re-position in the eyes of consumers as the ultimate online destination for hotels, not only price comparison.

TripAdvisor shifted its strategy to “instant booking” in 2015, effectively transforming into an online travel agency (OTA), directly competing with its former owner Expedia that spinned it off with complementarity and specialisation in mind in 2011.

Major Hotel chains have also emerged as competitors in the digital space. In 2016, Hilton launched the “Stop clicking around” campaign to promote discounts exclusively available for its HHonors loyalty program. AccorHotels launched “Le Club” a loyalty program with 2,800 participating hotels, offering exclusive discounts, points collection and special services, providing that bookings are made directly.

In this, context, the evolving business models of different players can be mapped to the online traveler customer journey, demonstrating how convergence is occurring across the value chain (See table 1) .

Table 1, online travel customer journey, Source: innovationtactics.com

From initial consideration to the moment of purchase, a wide range of players are competing with varying monetisation models. OTAs, differentiate through “killer sales pages”, advanced conversion optimisation techniques, while Hotel chains promote loyalty programs with benefits for direct bookings in their platforms by their members. TripAdvisor stands-out as a meta-search engine, particularly due its unmatchable number of reviews, while Trivago is promoting its enhanced price-comparison features.

Google’s ambition to deliver complete answers to its search users, has the effect of cross-boundary disruption, especially to players who do not have the resources to achieve scale.

3. TripAdvisor`s Business Model

TripAdvisor’s value proposition is to “connect users wishing to plan and book the best travel experiences with providers of travel accommodations and travel services worldwide.”

3.1 Segments and Revenue Streams

TripAdvisor’s business includes two segments, Hotel, and Non-Hotel, including click-based and transaction revenue, display based and subscription revenue, as well as other revenue.

3.1.1. Hotel

The Hotel segment is TripAdvisor’s biggest segment and historical growth driver, accounting for 80% of total revenue in 2016.

The introduction of “instant booking” in 2015, alongside CPC and CPM advertising, initially raised investor expectations, but did not take off with users, while having an adverse chain reaction effect to advertising revenues, contributing to negative (-5%) growth in 2016 and expected low (est. 1%) growth in 2017.

Additionally, revenue per hotel shopper, the ratio of CPC & transaction revenue to the total number of average users for 2016 was $0.46, down from $0.54 in 2015 and $0.56 in 2016.

Table 2, Hotel segment revenue and growth rates,

Source: fool.com/investing

TripAdvisor’s hotel business primary source of revenue is Cost-per-Click (CPC) advertising, where payments from advertisers (primarily OTA’s and Hotels) are based on the number of clicks (or shopping leads) multiplied by the price advertisers are willing to pay for each click/lead based on their calculated “equivalent commission”, determined via a proprietary, automated bidding and auctioning system.

Transaction revenue, is generated through the “instant booking” feature, which enables OTA and Hotel partners to pay commissions for users that complete reservations on the TripAdvisor website.

Another revenue stream is display-based advertising, sold typically on a cost-per-thousand-impressions (CPM) basis, to hotels, airlines, cruises and other destination marketers.

Subscription-based advertising, is sold, as a cheaper advertising solution, for a flat fee to hotels, beds & breakfast & specialty lodging properties, providing subscription-based listings with functionality to post special offers in TripAdvisor websites for a contracted period.

3.1.2 Non-Hotel

The Non-Hotel segment, including attractions, restaurants and vacation rentals, is TripAdvisor’s smaller but fast-growing segment, accounting for 9%, 15% and 20% of revenue in 2014, 2015, 2016 respectively.

In restaurants, revenue is generated by charging restaurants a flat fee for every restaurant guest that is facilitated through their online reservation system, while also providing an online booking and premium analytics tool for restaurants, through a subscription model.

In attractions, TripAdvisor charges operators a commission for each transaction facilitated through Viator.com, TripAdvisor’s dedicated attraction business.

Finally, TripAdvisor is in the vacations rentals business, providing research/booking information and services for short-term rental properties through its websites and mobile applications.

Property owners and/or managers can either list their properties for free with a commission-based option, or subscribe to an annual subscription-based fee.

Table 2 Non-Hotel segment revenue and growth rates, Source: fool.com/investing

3.2 Technology and Intellectual property

TripAdvisor has assembled a leading team of highly skilled technology professionals across disciplines (e.g.) software, hardware, data, systems, experience design) and areas of expertise (e.g. open source operating systems, databases, languages – incl. Java-, analytics, web architecture, iOS & Android mobile development, data management, devops, search engine optimisation, personalisation).

TripAdvisor’s systems infrastructure is distributed across different datacentres and development centres, monitored and protected through multiple layers, allowing high performance and security at-scale, constituting another integral resource.

Intellectual Property, is another source of competitive advantage, including trademarks, copyrights, domain names, patents, proprietary software and trade secrets. To protect its IP, TripAdvisor uses enforcement programs, IP licencing, restrictive terms of use, confidentiality agreements with suppliers, employees and clients, while also maintaining a trademark portfolio.

According to the 2016 annual report , TripAdvisor acknowledges the obvious limitations of competitors leveraging technology to create new products or methods, achieving similar outcomes without infringing upon owned patents.

3.3 Marketing

TripAdvisor is engaging in various marketing activities across channels. Targeted online traffic acquisition campaigns drive traffic, increasing customer engagement in search engines (e.g. AdWords), Social Media (e.g. Facebook) as well as retargeting (e.g. AdWords, DoubleClick) and mobile.

Traditional, above-the-line advertising is aimed at maintaining and growing brand value, consideration and loyalty, as well as publicise new features. Promotional direct-response campaigns, such as sweepstakes, giveaways, were launched in 2016 to support transaction revenue through the new “instant booking” feature.

TripAdvisor faces a ruthlessly aggressive landscape in marketing and advertising, being massively outspent by its key competitors.

According to industry reports, TripAdvisor’s spending in 2016 grew by 9%, in a low margin environment, to $756 million, while Expedia’s spending was $4.36 billion (up 29%) and Priceline’s $4.35 billion (up 23%), aiming to leverage the evolution of Google Search in a paid-marketplace through a race for scale that TripAdvisor doesn’t seem able to follow. 3.4 Search, Mobile and other Channels TripAdvisor is heavily reliant on Google Search, to drive revenue-generating traffic across channels.

Leveraging Search Engine Optimisation (SEO) and Search-Engine-Marketing (SEM) to place its content in top Search-Engine-Results-Placements (SERPs) for key traveler queries, such as “top hotels in London”, have driven TripAdvisor`s growth in reviews, revenue profitability.

Today, an estimated 81% of TripAdvisor inbound traffic comes from Google Search. Google’s strategy from a “search engine” to an “answers engine” , positioning Google products over organic results, presents a long-term, existential threat to TripAdvisor.

TripAdvisor also relies increasingly on mobile applications marketplaces, App Store and Google Play, to ensure discoverability of the TripAdvisor App. Social Media and e-mail marketing are other key channels for customer engagement, relationship managemen and activations.

3.5 Key Partnerships

TripAdvisor’s business relies on key partnerships with leading OTAs, notably Expedia and Booking.com, and other travel suppliers that purchase traveler leads through CPC, transaction and CPM advertising.

Furthermore, TripAdvisor has entered in contractual agreements with global hotel chains, including Accor, Best Western, Hilton, Marriott, as well as OTAs, to enable the “instant booking” feature, allowing travelers to book directly with 3rd party partners without leaving the TripAdvisor platform.

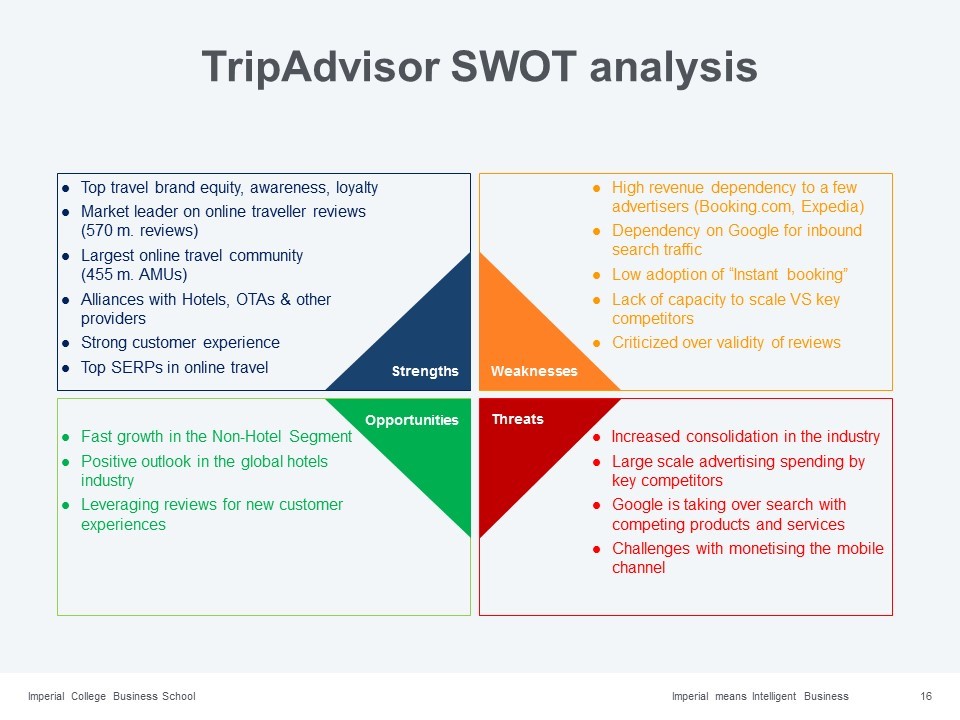

4. SWOT Analysis

In conclusion, TripAdvisor’s current (c. 2017) strategic reality is demonstrated in a SWOT analysis:

4.1 Strengths

TripAdvisor`s brand is a key source of competitive advantage, having earned awareness, loyalty and trust among travelers. Its 570m. reviews, supplemented by 115m. photos , are a unique differentiator for travelers, hotels and other providers.

Strong brand and user content have grown the platform into the largest online travel community with 455 million average monthly users , and have facilitated strong alliances with Hotels, OTAs and other suppliers.

Furthermore, TripAdvisor has been able to scale and deliver high quality experiences across channels, while having top placements in Google SERPs for high-value travel-related queries.

4.3 WEAKNESSES

TripAdvisor’s revenue is highly dependent on Booking.com and Expedia who in 2014 accounted for over 50% of revenue.

TripAdvisor`s traffic is heavily dependent on Google search, and subject to risk of depreciation from search-algorithm changes.

Thirdly, TripAdvisor’s shift to “instant booking” failed to get traction with users, impacting revenue, eventually leading to a partial reversal in 2017 , with no solution for revenue growth in sight.

TripAdvisor is also unable to match bigger competitors in terms of advertising scale, a pre-requisite to sustain its current business model.

Finally, as the number of user reviews is increasing, TripAdvisor is facing increasing criticism for inability to validate reviews and prevent fraud, threatening the credibility of the brand.

4.4 opportunities

TripAdvisor is facing long-term threats in the increasingly consolidated and competitive travel industry landscape.

The scale gap with key competitors, while Google is strategically entering the travel space through its SERPs, putting a key source of traffic (and hence revenue) acquisition for TripAdvisor at critical risk.

4.4 Threats

TripAdvisor is facing long-term threats in the increasingly consolidated and competitive travel industry landscape.

The scale gap with key competitors, while Google is strategically entering the travel space through its SERPs, putting a key source of traffic (and hence revenue) acquisition for TripAdvisor at critical risk.

5. Conclusion: Why TripAdvisor needs a turnaround

TripAdvisor`s current business model faces key strategic challenges. Revenue growth has reached a stalemate, as the instant booking feature in its main Hotel segment didn’t take-off while at the same time cannibalizing advertising revenue.

In parallel, the booking-focused online industry is consolidating and scaling creating adverse market conditions for TripAdvisor, as a stand-alone entity with a pure-play scale-dependent business model. To make matters worse, Google`s strategy is pushing TripAdvisor outside the traveler customer journey, with no plausible solution in sight to recuperate the emerging loss of inbound traffic from Google`s search results.

This reality is demonstrated in the stock market, where the stock price has lost 2/3 of its value since 2014, as the former travel unicorn is losing its appeal with investors.

Thus, it can be concluded that TripAdvisor needs a radical turnaround for long-term growth.

6. Problem: What could be TripAdvisor`s new model?

Subsequenty, the question arises:

What could be a new business model to allow TripAdvisor to leverage its strong brand, leading traveler community and vast number of hotel reviews, and create new customer experiences in a more favorable market environment?

7. Solution: “On-the-trip”, a new B2C/B2B value proposition

What if TripAdvisor looked beyond bookings, towards the “on-the-trip” part of the traveler journey and make its way inside the hotel room?

In recent years, Hotel In-room digital devices and experiences have appeared, but no clear incumbents or a coordinated market architecture have emerged. Technologies in this space however, are proliferating. Apart from tablets , new technologies, such as “digital concierge” services , or voice-enabled devices , are starting to be considered by hotel providers.

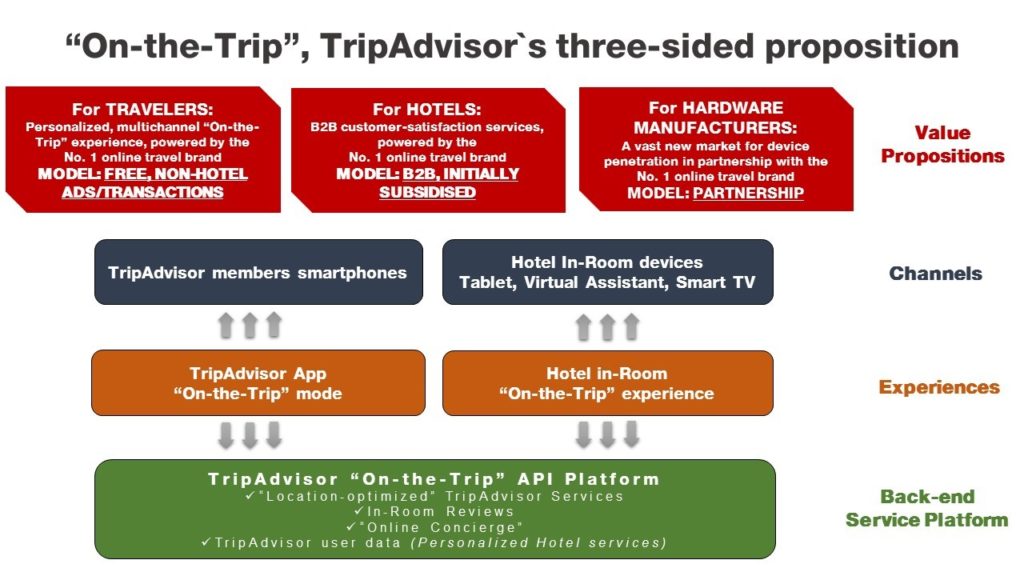

TripAdvisor is uniquely positioned το enter this space, due to its strong brand, ties with the traveler and hotel suppliers’ community and solid record of delivering excellent digital experiences. “On-the-trip” would be TripAdvisor`s three-sided value proposition for travelers, hotels and hardware manufacturers.

The value proposition to travelers would be “a personalized multichannel “on-the-trip” experience, built around their hotel stay, powered by the Number-1 online travel brand”.

The value proposition to hotels would be “Business-to-Business In-room guest satisfaction services, powered by the Number 1 online travel community in members and number of hotel reviews”.

The value proposition to hardware manufactures would be “a vast new market for digital devices` penetration in partnership with the Number 1 online travel brand”.

8. An API-driven technology offer

To leverage its core competencies and assets in digital service design and software development, TripAdvisor would enter this space as digital experience and software provider.

Flowchart 2, "On-the-Trip" three-sided value proposition and platform architecture

As shown in Flowchart-2, “on-the-trip” would be built on a back-end API platform developed by TripAdvisor, which would offer repackaged TripAdvisor services, enabling “on-the-trip” experiences based on trip-specific information (e.g. time of arrival, duration of the trip, recommended reservations in top restaurants, attractions etc.). Furthermore, the API would enable enhanced hotel review services to allow travelers to seamlessly review the hotel “in-room” during their visit (e.g. touch wizard, voice dictation etc.).

The platform would also develop new services for hotel providers, allowing them to tailor their own “Online Concierge” service, by customizing a generic API, or securely accessing TripAdvisor user data (e.g. previous bookings, preferences, interests, review analytics), to offer advanced personalized guest services.

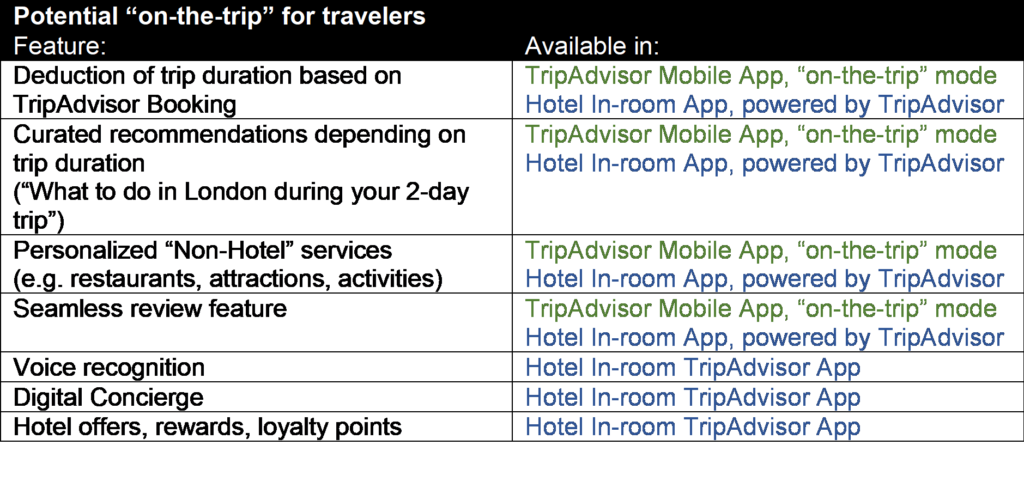

9.1 Travelers

Travelers would access TripAdvisor`s “On-the-trip” experience in their hotel room, through an application, built on TripAdvisor`s API, running on a digital device offered by participating hotels. The application would offer native TripAdvisor features and bespoke hotel services (see-table-4) built on TripAdvisor`s API, depending on the service level agreement between TripAdvisor and the hotel.

Secondly, the TripAdvisor mobile app would go to “on-the-trip” mode, offering travelers’ a personalized “on-the-trip” view for the duration of the trip(see-table-4), diminishing features that are less likely to be relevant (e.g. where to?, book a hotel). “On-the trip” mode would be monetized based on the current model of mobile advertising and transaction revenue. A connected experience would be possible allowing travelers to integrate the app in their own devices with the in-room device, if available.

Table 4, Potential "on-the-trip" features for travellers

9.2 Hotel Providers

Hotels would be offered multi-tier B2B subscriptions for “on-the-trip” services by TripAdvisor, including different levels of service:

- “on-the-trip” app for Hotels. Off-the-shelf app, available for Hotels to customize and load on in-room devices. TripAdvisor would manage software updates and offer dedicated support to hotels, charging a subscription model based on the number app installations. Apps would be developed for Android, iOS tablet devices, Smart TV`s and other devices depending on market demand.

- Access to API. Primarily offered to Hotel chains, API services would allow Hotels to develop, advanced personalized services and system integrations to their own digital services, loyalty programs (e.g. Earn Loyalty points for a TripAdvisor review) or CRM systems.

- End-to-End Solutions. TripAdvisor would also consider an integrated solution including the device, in partnership with a hardware manufacturer. Hotels would be able to set-up “on-the-trip” with a single commercial relationship, reducing administrative burden, also accessing advanced configuration, or installation options to fully incorporate the service into their room experience.

9.3 Hardware manufacturers

Hardware manufacturers would be engaged to explore the possibility of a partnership, alliance or joint venture, to leverage combined competences and resources to enter hotel rooms, a new market with huge potential for digital devices. Such a partnership seems plausible given that TripAdvisor lacks the resources and know how to manufacture devices, and manufacturers need TripAdvisor to gain the required brand equity and proposition strength to enter this space.

Potential partners could include Apple, to strengthen iPad and Siri personal assistant, Amazon, with their Echo and Alexa devices, or Samsung, with their wide range of premium tablets.

10. Risks

“On-the-trip” can be defined as a high-risk strategy for TripAdvisor, combining elements of a leap-frog strategy, as an investment on next-generation technologies in the travel industries, such as connected hotel rooms, digital concierge, as well as a left-field strategy, given that TripAdvisor would evolve to a new business model, entering the arena of B2B services, or partnering with hardware manufacturers. Key risks are identified below:

1. Travelers may not embrace the “on-the-trip” experience. If not delivered appropriately a hotel room experience may not be enticing to travelers. TripAdvisor should relentlessly focus on high quality user experience, considering potential impacting factors, including hardware, environment and data.

2. Hotels may not buy-in to the service. Even though TripAdvisor theoretically has the assets to make a strong proposition, cost or hardware concerns could prevent hotels from enrolling to TripAdvisor`s B2B services. TripAdvisor should consider pricing strategies for the purpose of match-making to create a positive feedback loop, as Hotels will be more incentivized to incorporate the service when seeing their competitors doing the same, to enhance their services, boosting reviews and rankings in TripAdvisor.

3. Bigger competitors may capture market share faster. Even through TripAdvisor lead in brand awareness and membership and number of reviews should provide a competitive advantage over competitors, bigger competitors could be faster in developing breakthrough technology, or creating key alliances with hotels or hardware manufacturers that would annul TripAdvisor`s initial advantage. TripAdvisor should ensure a key account with a major hotel chain and/or a partnership with a major hardware manufacturer before announcing the feature.

4. Competitors could copy technology. TripAdvisor should take sufficient steps to protect intellectual property, through trade secrets, copyright or patents. Patents should be considered especially for key process-driven features (e.g. hotel in-room voice reviews).

11. Execution

An indicative execution roadmap is depicted on flowchart 3. To ensure that “on-the-trip” is truly a user-centric experience, design thinking methodologies would be implemented through user experience research and rapid prototyping to design concepts incrementally and collaboratively, with a focus on customer value.

Flowchart 3, "On-the-trip" execution roadmap

TripAdvisor would develop a dedicated “on-the-trip” API platform, to ensure consistency of experiences across channels and interoperability of systems interfaces.

Existing TripAdvisor services and datasets (e.g. TripAdvisor review express API) would be re-packaged or optimized to fit the new offering, while new advanced services would be developed. From initiation, the first API release would be planned in conjunction with “on-the-trip” mode of the TripAdvisor App to create momentum for the new proposition.

B2B business development would be challenged to deliver key wins before live release of the platform to ensure that the new proposition has enough traction, increasing the risk of entry for second-movers. To this end, proof-of-concept prototypes would help early buy-in by prospective clients, while the initial offer is still under development.

“On-the-trip” would require combined B2C/B2B marketing efforts. An iconic traditional advertising campaign will be launched to raise awareness for “on-the-trip”, targeting public opinion. B2C Marketing will leverage digital paid/owned/earned media, to “sell” the new concept to travelers. In parallel, targeted B2B marketing actions will aim at enlisting hotels to TripAdvisor`s new offer.

Finally, partnerships with Hardware manufacturers would be pursued, but considering the complex nature of commercial negotiations, results from this activity should not be expected before the second major release.

12. Conclusion

This work introduced “on-the-trip” as a turnaround strategy for TripAdvisor driven by delivering personalized experiences to travelers during the duration of their trip, offering customer satisfaction services to Hotels, and seeking partnerships with device manufacturers to jointly penetrate the vast market of hotel rooms.

Today, TripAdvisor is trapped in its current business model, largely based on advertising revenue, heavily dependent on traffic, and exposed to disruption by Google and larger-scale competitors. By looking beyond bookings, shifting focus on delivering digital experiences ina different part of the customer journey, TripAdvisor will leverage its unique brand and establish its identity as the indisputable Traveler advisor, not only before or after, but also during their journey.

This new strategy is risky, but bold, with the potential of delighting travelers in unexpected ways, offering new services hotels, and re-inspiring investors, re-shaping the future of the number one online travel brand.

References

- Bianchi, R., Cermak,, M. and Dusek, O. (2016). More than digital plus traditional: A truly omnichannel customer experience. [online] McKinsey & Company. Available at: https://goo.gl/2hfg6Q [Accessed 22 Dec. 2017].

- Bughin, J., Chui, M. & Manyika, J. (2013) Ten IT-enabled business trends for the decade ahead. McKinsey& Company. [online] Available at: https://goo.gl/Gd8JUN

- Bussgang J. (2012). The Secrets to TripAdvisor’s Impressive Scale. Harvard Business Review [online] Available at: https://goo.gl/pSsH3q [Accessed 22 Dec. 2017].

- Calfas, J. (2017). Best Western Is Testing Voice-Activated Devices in Its Hotel Rooms. [online] Available at: http://fortune.com/2017/06/06/best-western-amazon/ [Accessed 22 Dec. 2017].

- Casadesus-Masanell, R. & Ricart, J. E. (2011) How to Design a Winning Business Model. Harvard Business Review. [online] Available at: https://goo.gl/SS4Lk1

- Christensen, C. M. & Rosenbloom, R. S. (1995) Explaining the attacker's advantage: Technological paradigms, organizational dynamics, and the value network. Research Policy. [online] Available at: https://goo.gl/dLfHoZ

- Christensen, C. The Innovator's Dilemma: When New Technologies Cause Great Firms to Fail. Harvard Business School. [online] Available at: https://goo.gl/CfC9io

- Delgado, P. (2016). The convergence of Google, TripAdvisor and Booking.com | . [online] Available at: https://www.mirai.com/blog/the-convergence-of-google-tripadvisor-and-booking-com/ [Accessed 22 Dec. 2017].

- Delgado, P. (2016). The perfect meta is yet to come | . [online] Available at: https://www.mirai.com/blog/the-perfect-meta-is-yet-to-come/ [Accessed 22 Dec. 2017].

- Department of Commerce Internet Policy Task Force (2013) Copyright policy, creativity, and innovation in the digital economy. [online] Available at: https://goo.gl/PJaAwd

- Dixon, C. (2011). The TripAdvisor IPO. [online] Business Insider. Available at: http://www.businessinsider.com/the-tripadvisor-ipo-2012-2?IR=T [Accessed 22 Dec. 2017].

- Eisenmann, T. R. (2008) Managing Proprietary and Shared Platforms case study. Harvard Business School. [online] Available at: https://goo.gl/dT1j6D

- Evans, D., Hagiu, A. & Schmalensee, R. (2006) Invisible engines how software platforms drive innovation and transform industries. MIT Press.

- Frank, S. J. (2006) Intellectual property for managers and investors: a guide to evaluating, protecting and exploiting IP. Chapter 7. Cambridge University Press. [online] Available at: https://goo.gl/N6bX2c

- Gawar, A. & Cusumano, M. (2008) How Companies Become Platform Leaders case study. Harvard Business Review. [online] Available at: https://goo.gl/N8GGVd

- Gould, A. (2017). TripAdvisor's Stumbles and Strengths in 4 Charts. [online] The Motley Fool. Available at: https://www.fool.com/investing/2017/09/29/tripadvisors-stumbles-and-strengths-in-4-charts.aspx [Accessed 22 Dec. 2017].

- IAC (2004). IAC Acquires TripAdvisor, Inc. | IAC. [online] Available at: http://iac.com/media-room/press-releases/iac-acquires-tripadvisor-inc [Accessed 22 Dec. 2017].

- Johnson, M., Christensen, C. & Kagermann, H. (2008) Reinventing Your Business Model case study. Harvard Business School. [online] Available at: https://goo.gl/uAKRZo

- Kastrenakes, J. (2016). Google Search now has travel guides to help plan your vacation. [online] Available at: https://www.theverge.com/2016/3/9/11179832/destinations-on-google-travel-feature-launches [Accessed 22 Dec. 2017].

- May K. (2011). TripAdvisor: Google abusing its power with Google Places - tnooz. [online] Available at: https://www.tnooz.com/article/tripadvisor-google-abusing-its-power-with-google-places/ [Accessed 22 Dec. 2017].

- Morningstar (2017). TripAdvisor Inc Top Competitors and Peers. [online] Available at: https://goo.gl/1YGRA5 [Accessed 16 Dec. 2017].

- Newton, C. (2016). Google Trips is a killer travel app for the modern tourist. [online] Available at: https://www.theverge.com/2016/9/19/12943054/google-trips-travel-app-android-ios [Accessed 22 Dec. 2017].

- O`Neil S. (2015). Half of TripAdvisor's revenue comes from Expedia and Priceline, analysts say - tnooz. [online] Available at: https://goo.gl/HVh88j [Accessed 22 Dec. 2017].

- O`Neil, S. (2015). Google quietly adds instant booking for hotels, copying TripAdvisor - tnooz. [online] Available at: https://www.tnooz.com/article/google-quietly-adds-instant-booking-for-hotels-copying-tripadvisor-via-desktop/ [Accessed 22 Dec. 2017].

- Oates, G. (2016). The Hotel In-Room Tablet Isn't Dead, It May Even Be Evolving. [online] Available at: https://skift.com/2016/01/05/the-hotel-in-room-tablet-isnt-dead-it-may-even-be-evolving/ [Accessed 22 Dec. 2017].

- Osterwalder, A. (2010) Business model generation a handbook for visionaries, game changers, and challengers. John Wiley & Sons. [online] Available at: https://goo.gl/Vx9yTY

- ParmarIan, R., Mackenzie, I. Cohn, D. & Gann, D. (2014) The New Patterns of Innovation. Harvard Business Review. [online] Available at: https://goo.gl/UP6hPU

- Pisano, G. P. & Teece, D. J. (2007) How to Capture Value from Innovation: Shaping Intellectual Property and Industry Architecture case study. California Management Review. [online] Available at: https://goo.gl/LKztdw

- Rangan, S. & Adner, R. (2001) Profits and the Internet: Seven Misconceptions case study. Harvard Business Review. [online] Available at: https://goo.gl/FbLJQn

- Razgaitis, R. (2009) Valuation and deal making of technology-based intellectual property: principles, methods and tools. Chapter 3. Wiley. [online] Available at: https://goo.gl/HE4ngP

- Rivette, K. G. & Kline, D. (2000) Discovering New Value in Intellectual Property. Harvard Business Review. [online] Available at: https://goo.gl/J9yD7D

- Schaal, D. (2012). How many hotels in the world are there anyway? Booking.com keeps adding them - tnooz. [online] Available at: https://www.tnooz.com/article/how-many-hotels-in-the-world-are-there-anyway-booking-com-keeps-adding-them/ [Accessed 22 Dec. 2017].

- Schaal, D. (2016). Google's New Mobile Tool Lets You Compare Destinations by Price. [online] Available at: https://skift.com/2016/03/09/googles-new-mobile-tool-lets-you-compare-destinations-by-price/ [Accessed 22 Dec. 2017].

- Schaal, D. (2017). TripAdvisor Is Being Massively Outspent by Its Biggest Rivals. [online] Available at: https://skift.com/2017/02/28/tripadvisor-is-being-massively-outspent-by-its-biggest-rivals/ [Accessed 22 Dec. 2017].

- Schaal, D. (2017). TripAdvisor Scales Back Instant Booking in Strategy Reversal. [online] Available at: https://skift.com/2017/05/08/tripadvisor-scales-back-instant-booking-in-strategy-reversal/ [Accessed 22 Dec. 2017].

- Scotchmer, S. & Maurer, S. (2004) Chapter 3: A primer for non-lawyers on intellectual property in "Innovation and incentives". [online] Available at: https://goo.gl/oTbP4Y

- ScreenCloud. (2017). Journey around the smart connected hotel of the future. [online] Available at: https://screen.cloud/connected-spaces/hospitality-spaces/smart-connected-hotel [Accessed 22 Dec. 2017].

- Shapiro, C. (1999) Information Rules a strategic guide to the network economy. Chapters 4,5,6,7,8,9 Harvard Business School. [online] Available at: https://goo.gl/XT8SHc

- SimilarWeb (2017). tripadvisor.com Traffic Statistics. [online] SimilarWeb. Available at: https://www.similarweb.com/website/tripadvisor.com [Accessed 22 Dec. 2017].

- Skift. (2017). How the Digital Concierge Is Reshaping the Hotel Industry. [online] Available at: https://skift.com/2017/07/20/how-the-digital-concierge-is-reshaping-the-hotel-industry/ [Accessed 22 Dec. 2017].

- TripAdvisor (2017) Annual Report 2016

- TripAdvisor.com (2017). [online] Q3 Investor Presentation, (As above)

- TripAdvisor.com (2017). [online] Q3 Investor Presentation, Slides 5-7, Available at: https://goo.gl/GxY9sY [Accessed 16 Dec. 2017].

- TripAdvisor.com (2017). Q3 results [online] Available at: https://goo.gl/enQCR7 [Accessed 16 Dec. 2017].

- Uenlue, D. (2017). Customer journey comparison: Booking.com, Expedia, TripAdvisor. [online] Innovation Tactics. Available at: http://www.innovationtactics.com/business-model-customer-journey-travel-booking/ [Accessed 22 Dec. 2017].

- Xotelier.com. (2017). XOtelier for hotel tablets. [online] Available at: https://xotelier.com/en/in-room-service-app/ [Accessed 22 Dec. 2017].

- YouTube. (2013). Trivago TV commercial. [online] Available at: https://www.youtube.com/watch?v=BW8WoHP1fQY [Accessed 22 Dec. 2017].

- YouTube. (2014). Trivago TV commercial. [online] Available at: https://www.youtube.com/watch?v=06pYY_0zLQs [Accessed 22 Dec. 2017].

- YouTube. (2017). Google Travel's VP of Engineering at Skift Global Forum 2016. (from 6’ 26’’ to 8’10’’) [online] Available at: https://www.youtube.com/watch?v=taHQB3M3HKE [Accessed 22 Dec. 2017].