Competition for Apple Pay in the nascent mobile payments market

The adverse impact of fragmented market architectureThis report analyses the forces of direct and indirect competition for Apple Pay (as of Q4 2017), presents key contemporary market trends and influencing factors, and concludes with predictions for the future of mobile payments.

Apple Pay Competitive Analysis

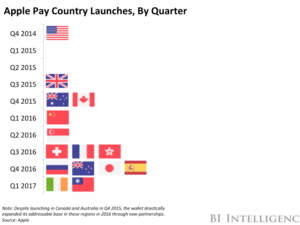

Apple entered the mobile payments market with Apple Pay in 2014, finally incorporating NFC to iPhone 6. This decision was driven by confidence in Apple’s superior brand and user experience, key partnerships with Credit/Debit card issuers, and expectation for convergence towards “tap-n-pay”, NFC-based eWallet applications.

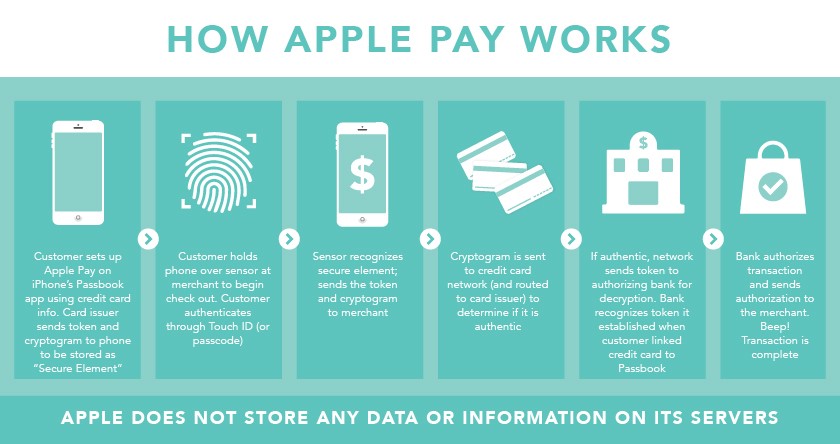

Apple Pay’s direct competitors are major eWallets, including Google Wallet and Samsung Pay. Comparing the three (Appendix-Table 1), no clear winner emerges. Apple Pay stands out for superior user experience and security, storing no data on Apple servers, while Google Wallet is available as an app on any device. Samsung Pay, while limited to Samsung devices, has an NFC-alternative, allowing compatibility with older card machines, massively expanding accepted locations. According to Apple executives, Apple Pay is leading in key markets accounting for 70% of global card payment volume, delivering 90% of mobile transactions.

Apple`s is approaching mobile payments as a cross-boundary disruptor, seeking to converge mobile and fintech, like its previous disruption of music, telecoms and computing with iTunes and iPhone. In this context, Apple is facing coopetition by adjacent banking and retail players, with key stakes in payments.

Most of USA and Canada`s financial services institutions support Apple Pay. However, a key threat for bank executives is the danger of becoming “plumbing”; a commoditised payments infrastructure, on which eWallet can develop customer experiences, dominating the most lucrative part of the value chain. Thus, Banks are creating their own ecosystems in parallel, aspiring to offer competing, cutting edge experiences to their customers.

In a similar context, merchants are frenemies to Apple Pay. TechCrunch reported that Apple Pay is accepted by 50% of US retailers, including 67% of the top-100, despite hefty commission fees. However, merchant integrations are often compromised, due to complexity (e.g. Kohl`s loyalty card), or competing initiatives (e.g. Kohl`s payment app). Walmart and BestBuy are going further, not backing Apple Pay. Walmart Pay was rolled-out in 2016, leveraging Walmart`s 4,600 locations to tap into the fast-growing mobile payments market, and improve customer satisfaction through faster in-store checkouts.

Fragmented market architecture and the future of mobile payments

Since early days, the Mobile Payments market has suffered from disagreement, initially between network operators and banks, over “ownership” of (a)customers and (b)security concerns. The resulting coordination failure led to slow emergence, with NFC-chip cards winning the adoption race, and fragmentation, with highly varying local solutions leading to adverse network effects.

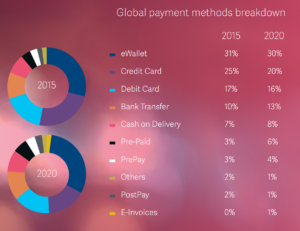

Since 2011, mobile payments have grown significantly. Per WorldPay, by 2015 “eWallets” were the leading payment method globally, accounting for 31% of total spent. However, growth has not met expectations, due to the convenience of NFC-contactless giving cards new life, limited availability of mobile eWallets in older-technology phones slowing adoption, and merchants` wait-and-see approach to avoid switching costs until full technology convergence.

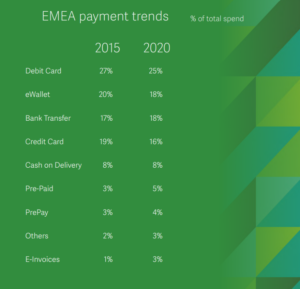

Furthermore, observing regional data (Appendix-Tables 2-5), global growth is driven by China, rather than growth in affluent western markets, where eWallets are still behind cards. Enjoying late-mover advantage and stronger coordination, China`s mobile payments have come to dwarf US by 50:1.

Looking to 2020, mobile payments are predicted (See table 1) to grow in N.A., stay stagnant in EMEA/LATAM, and drop in Asia, due to card schemes` expansion in China and alternative methods, such as cash-at-delivery and banking transfers, in India.

Table 1 Global payment methods breakdown, WorldPay Global Payment Report 2016

Four key factors will determine the future of mobile payments:

- Firstly, the extension of eWallets to web unify offline/online payment methods for shoppers.

- Secondly, the increase in NFC compatibility, as more consumers upgrade old smartphones and merchants replace in-store terminals.

- Furthermore, the integration of value-adding services, such as budgeting, loyalty schemes, which will determine eWallets` overall attractiveness.

- Finally, overcoming “fragmentation of payment ecosystems”. Worldpay emphasises the need for more data connections and “closer collaboration between competing organisations to make the mobile eWallet experience seamless enough to attract modern consumers”.

Conclusion

Apple Pay faces fierce competition from eWallet competitors, and “coopetition” from banks and merchants. Apple’s competitive advantages are premium brand, user experience, and security, while compatibility, merchant switching costs and fragmentation need to be overcome.

Despite recent growth, mobile payments are still struggling to meet expectations due to insufficient collaboration. Overall, the risks raised by Ozcan and Santos of market no-emergence due to coordination failure are more relevant than ever, as modern consumers increasingly demand completely seamless and unified payment experiences.

Tables and graphs

Table 2 eWallets comparison, CNN Money https://goo.gl/bzpS4S

Table 3 North America payment methods breakdown, WorldPay Global Payment Report 2016

Table 4 EMEA payment methods breakdown, WorldPay Global Payment Report 2016

Table 5 Latin America payment methods breakdown, WorldPay Global Payment Report 2016

Table 6 Asia payment methods breakdown, WorldPay Global Payment Report 2016

Table 6 Apple Pay Country Quarterly Launches, BI Intelligence https://buff.ly/2lFi8mT

Spreedly.com. (2017). Apple Pay Description. [online] Available at: https://goo.gl/aHeEaY [Accessed 3 Nov. 2017].

References

- Accenture. (2017). 10 Mega Trends Driving Future of Payments. [online] Available at: https://goo.gl/xLVujH [Accessed 1 Nov. 2017].

- Adage.com. (2016). Apple Pay Facing Stiff Competition from Retailers' Mobile-Payment Services. [online] Available at: https://goo.gl/Gvjuan [Accessed 1 Nov. 2017].

- Burgelman, R.A. & Grove, A.S. (2007) Cross-boundary disruptors: powerful interindustry entrepreneurial change agents. Strategic Entrepreneurship Journal.

- DigitasLBi (2016). Online Shopper in 2016: All Grown Up (Study). [online] Available at: https://goo.gl/5Xqyss [Accessed 1 Nov. 2017].

- Dunkley, E. (2015). UK banks seek to Zapp Apple with digital payment services. [online] Financial Times. Available at: https://goo.gl/iioT3Q [Accessed 3 Nov. 2017].

- Economist. (2017). In fintech, China shows the way. [online] Available at: https://goo.gl/KwyjYb [Accessed 25 Oct. 2017].

- Ewing, D., Leberman, D., Rajgopal, K., Serrano, E. and Steitz, J. (2014). The keys to driving broad consumer adoption of digital wallets and mobile payments. [online] McKinsey & Company. Available at: https://goo.gl/TDhzqG [Accessed 26 Oct. 2017].

- Lunden, I. (2017). Apple Pay now in 20 markets, nabs 90% of all mobile contactless transactions where active. [online] TechCrunch. Available at: https://goo.gl/Yy2TAe [Accessed 3 Nov. 2017].

- Mortimer, N. (2015). Lloyds Bank digital transformation chief– ‘we are in danger of just becoming the plumbing’. [online] The Drum. Available at: https://goo.gl/vtQpgf [Accessed 29 Oct. 2017].

- Ozcan, P. and Santos, F. (2015). The market that never was: Turf wars and failed alliances in mobile payments. Strategic Management Journal, [online] 36(10), pp.1486-1512. Available at: https://goo.gl/NFCwZe [Accessed 29 Oct. 2017].

- Rossignol, J. (2014). Apple earns 0.15% commission on every Apple Pay transaction. [online]. Available at: https://goo.gl/DPaK8A [Accessed 3 Nov. 2017].

- Schuman, E. (2016). Kohl's Apple Pay deal illustrates why mobile wallet is a lot harder than it looks. [online] Computerworld. Available at: https://goo.gl/RH8kgf [Accessed 3 Nov. 2017].

- Wahba, P. (2016). Kohl's Pay Is the Latest Combatant In the Payment App Wars. [online] Fortune. Available at: https://goo.gl/0InocX [Accessed 3 Nov. 2017].

- Wildau, G. and Hook, L. (2017). China mobile payments dwarf those in US as fintech booms, research shows. [online] Financial Times. Available at: https://goo.gl/puQ9rj [Accessed 3 Nov. 2017].

- Wisniewski, M. (2014). Why Banks Are Buying In to Apple Pay. [online] American Banker. Available at: https://goo.gl/AruvoV [Accessed 1 Nov. 2017].

- WorldPay Payment Report. (2016). [online] Available at: https://goo.gl/836C79 [Accessed 1 Nov. 2017].