Prime: Amazon's "trojan horse"

A deep dive on Amazon's bundle pricing strategy, focusing on Prime's 18% price increase in early 2018Executive Summary

This report focuses on Amazon’s bundled subscription service, Prime, and its decision to increase price by 18% in 2018, for monthly subscribers in February, and annual subscribers in May.

Firstly, current practices are briefly presented, providing background on Prime’s pricing history, all-inclusive physical/digital bundle structure, value proposition as “the best deal in the history of shopping”, and strategy as the “trojan horse” of Amazon’s flywheel.

Consequently, a pricing strategy analysis is conducted, attempting to unpack the reference customer value included in different Prime components, and, comparing with the ex-ante/ex-post price of Prime, deduces that Prime continues to be good-value-for-money, from a reference value standpoint, after its price increase, delivering an estimated 4.1x-5.7x more value than its new annual price.

Furthermore, the differentiation value of Prime is considered, accounting for positive and negative factors, leading to the conclusion that the Prime’s overall economic value to the customer is augmented due to differentiation.

Finally, this work takes the perspective of Amazon to offer future recommendations, including (a) stress-testing the Prime model at-further-scale in order to manage shipping costs that, according to third party research, appear to be escalating, (b) considering unbundling of Prime services, and (c) stepping up efforts to proactively manage consumer perception or societal concerns, over fairness or predatory pricing, with the potential to disrupt Amazon’s flywheel model, as its Prime business is scaling at unprecedented levels.

Background

Prime’s two-phased price increase of 2018

On January 2018, Amazon announced an 18% increase in the price of monthly Prime membership in the US, from $10.99 to $12.99 for regular members, and from $5.49 to $6.49 for Students. On the other hand, prices remained constant for Annual Prime members, $99 and $49 for regular and student members respectively, while pure-play Prime Video subscribers continued to pay $8.99/month. Four months later, Amazon increased the annual price of Amazon Prime by 18%, from $99 to $119 , justifying the increase by the continuous increase in the value of Prime, also pinpointing the rising costs of the breadth of Prime services, as membership is growing, reaching 100 million globally.

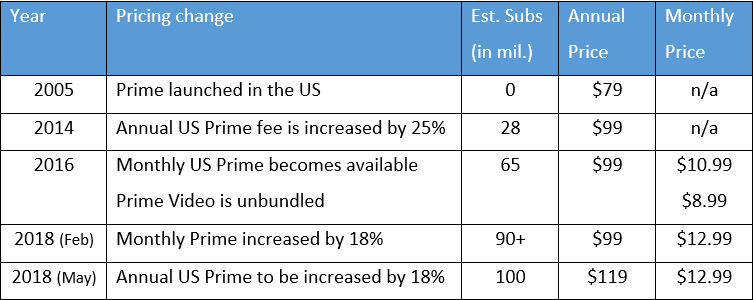

The 18% price increase in 2018 is effectively the second major increase in the 12-year history of Amazon Prime (see table 1).

Table 1 Amazon Prime evolution in subscribers and price, 2005-2018

Prime was announced during an earnings’ call in 2005, as a subscription-based, unlimited two-day shipping offer on approximately one million items for an annual $79 membership fee. Prime was initially met with skepticism, with questions raised on whether this new concept of paying for fast delivery would resonate with consumers, or whether Amazon would be able to “foot the bill” if the scheme succeeded. However, Prime grew consistently, both in terms of number of subscribers and scope of services, eventually becoming “bigger, more powerful, more profitable than anyone imagined”.

Prime's bundle, an all-inclusive, physical/digital subscription

Prime has evolved from a free/fast delivery program into a unique, hybrid physical retail/digital media subscription bundle. Today, the official Amazon Prime web-page lists 24 core benefits and services in the US, spanning across categories:

- Shipping (including free two/same-day/ultra-fast delivery for 100 million items)

- Streaming (including Video, Music)

- Shopping (including rewards/discounts, Dash, Fresh, Pantry and Alexa voice-shopping)

- Reading (including Reading, Washington Post 6-month trial)

- Storage (including Photos in amazon drive)

From a bundling perspective, Prime started as a pure bundle, offering its diverse and growing services in a single-priced package. Amazon changed its strategy to mixed bundling in 2016, unbundling Prime Video for $8.99, $2 less than the all-inclusive Prime offer. Today, Amazon also offers supplemental memberships as add-ons:

- Amazon Fresh, grocery delivery and pickup

- Amazon Channels, including HBO, Showtime, Starz

- Prime Pantry, low-priced everyday essentials

“The best deal in the history of shopping”

Amazon positions Prime as a value-maximising customer proposition. As Jeff Bezos famously stated in 2016, “We want Prime to be such a good value, you’d be irresponsible not to be a member.”. Amazon is facing fierce competition in each one of Prime categories. In delivery, Walmart is offering 2-day shipping without a membership fee,while start-ups like ShopRunner/Postmates, are gaining traction offering premium delivery options to consumers.

Video streaming is becoming a “red ocean”, with Netflix outspending Amazon in unique program content production, while traditional studios are consolidating to scale. In Music, Spotify continues to lead and grow, while Apple and Google are strengthening their own offers.

However, no company, other than Amazon, is anywhere near to offering Prime’s breadth of features as a single all-inclusive bundle in such a competitive price, close to what each one of most competing services cost. According to JP Morgan, Prime is the “best deal in the history of shopping”, priced 7 times less than its true value, and rapidly, making it difficult for other companies to compete.

Prime strategy: the “trojan horse” of Amazon’s flywheel

Jeff Bezos explained the interdependence between the different components of Prime in a 2016 interview about how Amazon monetises investments in video content:

“We get to monetize that content in a very unusual way. Because when we win a Golden Globe, it helps us sell more shoes. And it does that in a very direct way. Because when people become Prime members they buy more on Amazon than non-Prime members.”

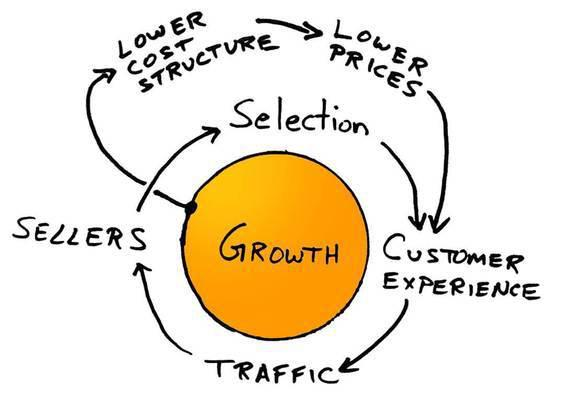

Per Morgan Stanley, as of September 2017, the weighted average spend per-shopper was 4.6x higher for Prime members, compared to Non-Prime. Prime can be defined as the core and “trojan horse” of Amazon’s flywheel, the strategic concept of creating virtuous circles at every step of the value chain, realizing the vision for customer obsession and exponential growth.

Scheme 1 The Amazon Flywheel, available at www.amazonianblog.com

Prime is signing up customers, offering free delivery and a breadth of other benefits in a dis-proportionally low price. Prime Members are less likely to shop around, spending more on Amazon, consequently leading to more traffic, attraction of new sellers, bigger product selection, and an ever-improving customer experience. Growth is re-invested in lower cost structure and more customer benefits, the Prime proposition becomes all and more difficult to resist, spinning the Amazon flywheel faster as it grows; growth itself is an accelerator for further growth.

An analysis of Prime’s 2018 price increase from an economic-value-to-the customer perspective

Approach

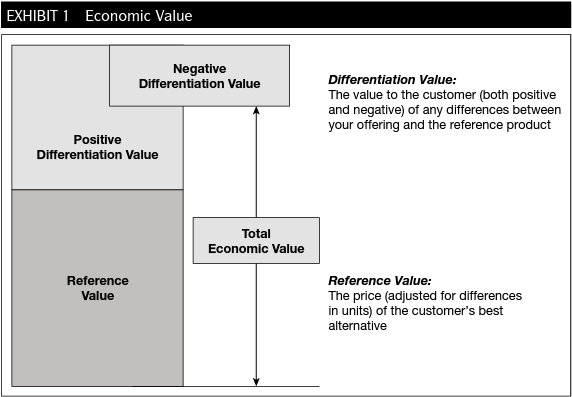

Per Nagle et. al (2014), total economic value for a product/service [such as Amazon Prime] can be defined as a function of (a) reference value, an informed customer’s best alternatives, plus (b) differentiation value, the “worth of whatever differentiates the offering from alternatives”. Exhibit 1 visualises this relationship driving total economic value; the maximum price a “smart”, fully informed and value-optimising customer would be willing to pay.

Exhibit 1 Nagle et. al (2014) The Strategy and Tactics Pricing. Total Economic Value

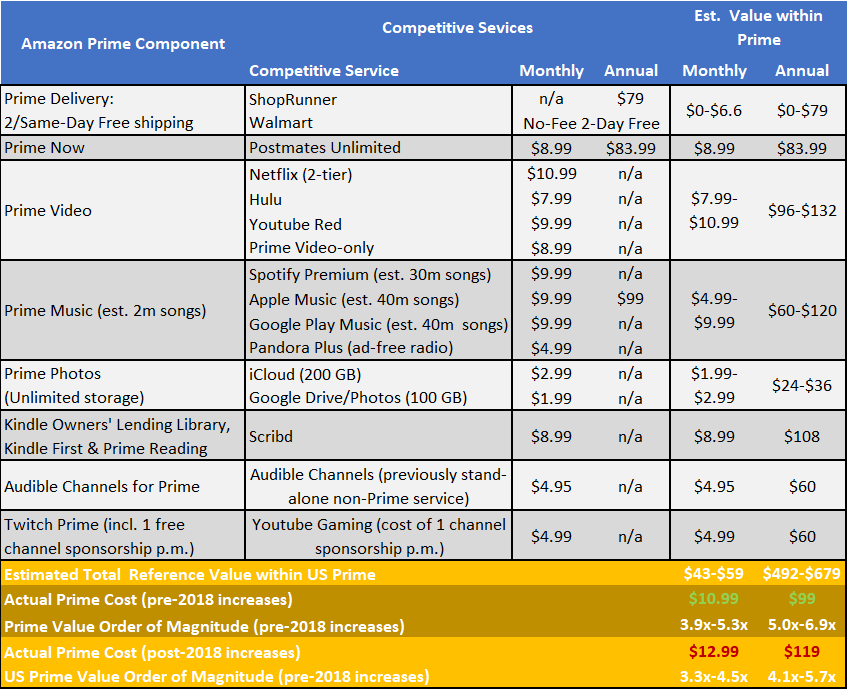

In May 2017, JP Morgan’s research unit compiled a report on Amazon Prime, expressing the opinion that “unbundling all Prime components reveals a package of offerings was worth approximately $700/year, 7x the actual $99 annual Prime subscription cost”. This work takes inspiration from JPMorgan’s approach, attempting to update this model based on present day reality, benchmarking Prime with similar competitive alternatives to estimate the current worth of Prime offerings using a reference value approach, assessing the impact of the two-phase 2018 price increase on Prime’s “value-for-money” worth to customers.

This work attempts to “unpack” the customer value of Amazon Prime by identifying the service’s closest competitive alternatives for each one of the key Prime components. Pricing structures, monthly and annual (or estimated equivalents), are then compared to estimate the reference value within Prime for each one of the different components.

Total values are then divided by the actual price of Amazon Prime, before and after the 2018 increase, to form a “value-for-money” ratio for Prime, demonstrating the relative relationship reference value and actual price.

Reference Value Analysis, Standard and Ultra-Fast Delivery

Amazon Prime offers free two-day shipping for over 100 million items, as well as same-day shipping and Prime now for eligible products and locations. Following the failure of its ShippingPass paid-subscription, Walmart has put in place a subscription-free two-day shipping policy, aimed at disrupting Prime, eligible for more than 2 million items and orders over $35, also offering in-store shipping (while Amazon is limited to Lockers).

While the scope of its offer is considerably limited compared to Prime (2 versus 100 million items), Walmart’s policy would have the capacity to disrupt Prime, had it not been for all its other perks, as well as Prime’s penetration of high-income households that are less likely to shop on Walmart.

ShopRunner, another free 2-day shipping service comparable to [the 2-day shipping of] Prime, albeit considerably smaller in size, offers access to premium retailers, such as Neiman Marcus, GNC and the NFL Shop, priced at $79 per year.

In same-day, ultra-fast delivery, Prime Now offers tens of thousands of items in selected urban locations during daytime, included in the US Prime bundle. Postmates unlimited is a relatively comparable service with relatively bigger offering and stronger focus on restaurants than Amazon Prime Now, leveraging a network of 100,00 delivery people in 200+ cities, priced at $9.99 a month/$83.99 per year.

Based on the above, the unpacked value of Prime Standard Delivery and Prime Now based on the market prices of similar alternatives is:

- Prime Standard Delivery: From $0, for low-price seekers who cover their needs with Walmart free shipping, to £79 p.a. (or the equivalent $6.6 p.m.)

- Prime Now: $8.99 p.a./$83.99 p.m., under the assumption that Postmates Unlimited is seen as a comparable service to Prime Now

Reference Value Analysis, Other Prime Categories

Following the same logic, the basic version of Netflix, Hulu, YouTube Red and the unbundled version of Amazon Video were identified as direct alternatives to the Amazon Prime offer of on-demand streaming. For Music, alternatives included the premium services of Apple Music, Google Play Music and Spotify premium, as well as the more low-fi Pandora Plus, primarily including ad-free radio stations.

Prime Photos, offering unlimited storage was compared with iCloud and Google Drive/Photos, offering similar services, albeit with a storage limit, of 200GB and 100GB respectively. Scribd premium was considered a fair overall alternative, to the combined Prime offer for reading, consisting of Kindle Owners’ Lending Library, Kindle First and Prime Reading.

Lastly, the price for the previously stand-alone Audible Channels service was taken into consideration, while the cost of a single channel sponsorship in YouTube Gaming, was considered a close alternative to Twitch Prime, including 1 free subscription/sponsorship p.m. in the bundled Prime subscription.

Reference Value Analysis, “Unpacked” Prime reference value Calculations

Consequently, the total “unpacked” reference value included in the bundled Prime Membership is calculated as a range, varying depending on customer preferences in categories with multiple, differently-priced alternatives, between $43-$59 calculated monthly, or $492-$679 annually.

Dividing reference value with the actual cost of US Prime, a Prime Value Order of Magnitude is deduced demonstrating the relationship between reference value and price tag, a “value-for-money” ratio for Prime before and after the two-phased price increase of 2018. The total unpacked value of Amazon Prime pre-price-increase is calculated between 3.9x-5.3x the monthly cost of Prime, and 5x-6.9x annually. Post-price-increase, Prime’s value-for-money ratio falls to 3.3x-4.5x monthly, and 4.1x-5.7x annually.

Figure 1, Total Reference Value to Price ratio for Prime, April 2018

Reference Value Analysis, Conclusion

The above calculations lead to a first conclusion that, from a reference value perspective, Amazon Prime continues to deliver overwhelming value-for-money to subscribers, despite the 18% price increase. Certainly, it should be stated that this model, if considered as a stand-alone, can be misleading, given that not all Prime customers see the same value, or in some cases do not see any value, in different Prime benefits. eMarketer research showed that, as of 2015, free and quick shipping was the most important factor for almost 80% of respondents, while other benefits were not yet seen as valuable enough by customers to independently drive subscriptions. Since 2015, Amazon has been investing heavily in enriching and expanding Prime Benefits, with increased video content production investment, the Whole Foods acquisition and ground-breaking success of Alexa, being some examples, indicating the “multidimensional” acceleration of the Prime Flywheel.

3.6 Considering Prime’s differentiation value

In addition to reference value, Amazon has strategically aimed to make Prime a unique offer, with exclusive perks for its members, while key elements of Prime are already offering differentiation value to Amazon subscribers.

Firstly, Prime Day is more than an Amazon anniversary, but Amazon’s proprietary re-definition of Black Friday in a digital context, exclusively available to Prime subscribers.

Secondly, since 2016, Amazon has silently begun labeling some items as Prime-exclusive, removing the “add to basket” button for everyone else, starting to build exclusivity for the Prime Brand. Thirdly, Prime members can exclusively access “Just for Prime”,exclusive deals and product promotions.

Furthermore, while it is possible to purchase and use Alexa-powered Echo devices, with trending/emerging functionalities, such as voice-purchasing, the Amazon dash or Amazon Key are (or will be) exclusively available for Prime members.

Concluding Recommendations

1. (Continue to) Obsess with Customers and Data

Whatever the marginal outcome in Amazon’s bottom line, the decision to increase Prime’s subscription price is a unique opportunity for Amazon to “check-in” with the market and capture big data to drive future decisions in pricing, marketing and product development. Key indicators, such as price elasticity of demand, existing subscriber churn, trial conversions, new/total subscriber-growth, will be captured from an unprecedented data set of 100 million subscribers, leading to deeper insights into customer behaviour, which have been Amazon’s secret weapon for growing its business from Day 1. Amazon should continue to focus on its metrics-driven culture to maximise lessons-learned, optimise their marginal thinking and continuously evolve and differentiate its Prime Offering, driven by data and customer obsession.

2. Re-consider Prime’s bundle structure as it is reaching PLC maturity

As Prime is reaching its phase of maturity, and its millions of subscribers are increasingly leveraging free delivery to shop in Amazon, the shipping costs of Prime are spiralling, making price increases an unavoidable decision.

As Jeff Bezos famously said 15 years ago:

"There are two kinds of retailers: those folks who work to figure how to charge more, and companies that work to figure how to charge less, and we are going to be the second."

As the Amazon flywheel is accelerating, Prime is becoming a massive offer in terms of scope, value, costs and, eventually, price. Serial increases in the price of Prime are bound to lead to contradiction. Even though the aggregate value of Prime’s offerings continues to exceed price many times even after the last increase, Amazon and J. Bezos are starting to be portrayed by media as inconsistent and exploitative. Furthermore, two 18% increases in four months, albeit referring to different customer segments, can have an impact in consumer psychology, triggering “price hike” sentiments, which have not historically resonated well with consumers.

Some go further, suggesting that Amazon Prime is a case of predatory pricing, due to its massive scale, free cash flow and initially ridiculously low prices, which are increasing in line with signs of market domination.

Amazon should stress-test the bundled Prime business model, putting pricing strategy considerations, especially with regards to the feasibility of further price increases, at the center of its attention. Unbundling of Prime, following the example of Prime Video or other discrimination strategies could be considered as alternatives to ensure sustainability of Prime, as it is reaching the mature phase of its product life-cycle.

4.3 Pursue Fairness

Amazon’s exponential growth and dominance is met with increasing societal concerns. As Amazon’s continues to disrupt industries and consume traditional market leaders to fuel its conglomerate growth, it is logical to expect that such concerns will increase across the spectrum.

In Amazon’s case, it can be stated that being perceived by public opinion at-large as benevolent and fair are key pre-requisites for Amazon to sustain its market and pricing power. Prime’s price discrimination policy in favour of students and low-income households is a good example of pricing practices that Amazon could scale to strengthen its socially-responsible profile.

Amazon should focus on the idea that society-at-large is entitled to a fair rate return from Amazon’s exponential growth;

And adopt strategies throughout its value chain to pay forward part of this value-add [deriving from the extraordinary trust and loyalty of Amazon customers] to society.

References

- Bezos, J. (2016) Letter to Amazon.com Shareowners [online] Available at: sec.gov [Accessed 26 Apr. 2018].

- Boudet, J. et. al (2015). The Prime Day play: Three lessons from Amazon's one-day event. [online] Available at: mckinsey.com [Accessed 28 Apr. 2018].

- Burch, S. (2018). Amazon Key Will Deliver Packages Straight to the Trunk of Your Car. [online] TheWrap. Available at: thewrap.com [Accessed 28 Apr. 2018].

- Cartmel, P. (2016). Prime Day 2016: A Big Tuesday for All Ecommerce Brands. [online] Adage.com. Available at: adage.com [Accessed 28 Apr. 2018].

- Castillo, M. (2018). Amazon hikes Prime subscription price to $119 a year, straying from Jeff Bezos' vow to 'charge less'. [online] CNBC. Available at: cnbc.com [Accessed 29 Apr. 2018].

- Digital TV Europe. (2017). Amazon to up video investment in 2018. [online] Available at: digitaltveurope.com [Accessed 28 Apr. 2018].

- Dolan, A. (2014) WHSmith axes honesty boxes as shoppers aren't honest!. Daily Mail.

- Dolan, R. J. (1994) Eastman Kodak Company: Funtime Film Case Study. Harvard Business School.

- Dubner, S. J. (2006) How Is a Canadian Art-Pop Singer Like a Bagel Salesman?. Freakonomics.

- Duhigg, C. (2012) How Companies Learn Your Secrets. New York Times.

- Duryee, T. (2015). Amazon justifies big investments in Prime, saying ‘It’s a great platform to feed’. [online] GeekWire. Available at: geekwire.com [Accessed 28 Apr. 2018].

- Ebook Friendly. (2018). How much does Amazon Prime membership cost in your country? (comparison). [online] Available at: https://ebookfriendly.com/amazon-prime-membership-price-comparison/ [Accessed 10 Apr. 2018].

- eMarketer, RBC Capital Markets. n.d. Most popular reasons for users in the United States to join Amazon Prime from 2013 to 2015. Statista. Accessed 28 April, 2018. Available from https://www.statista.com/statistics/304945/us-amazon-prime-usage-reason/.

- En.wikipedia.org. (2018). Amazon Prime. [online] Available at: https://en.wikipedia.org/wiki/Amazon_Prime [Accessed 24 Apr. 2018].

- Feldscher, K. (2018). Bernie Sanders: Trump is right, Amazon has gotten too big. [online] Available at: washingtonexaminer.com [Accessed 30 Apr. 2018].

- Fiegerman, J. (2018). Amazon is raising the price of Prime to $119. [online] CNNMoney. Available at: money.cnn.com [Accessed 27 Apr. 2018].

- Fortune. (2018). Amazon's Prime and punishment. [online] Available at: http://fortune.com/2012/02/21/amazons-prime-and-punishment/ [Accessed 10 Apr. 2018].

- Gobel, B. (2018). New Amazon Prime Membership for Low-Income Households. [online] AARP. Available at: aarp.org [Accessed 30 Apr. 2018].

- Gourville, J. T. & Soman, D. (2002) Pricing and the Psychology of Consumption Case Study. Harvard Business Review

- Gourville, J. T. (1999) Note on Behavioural Pricing Case Study. Harvard Business Review.

- Hill, K. (2012) How Target Figured Out A Teen Girl Was Pregnant Before Her Father Did. Forbes.

- Indounas, K. (2006) Making Effective Pricing Decisions. Business Horizons.

- JP Morgan (2017) North America Equity Research, May 17th, 2017

- Kiger J., P. (2018). 10 ways Alexa makes life easier for Prime members. [online] Available at: amazon.com [Accessed 28 Apr. 2018].

- Kim, E. (2018). One phrase that perfectly captures Amazon’s crazy obsession with numbers. [online] Business Insider. Available at: uk.businessinsider.com [Accessed 29 Apr. 2018].

- King, C. & Narayandas, D. (2000) Coca-Cola's New Vending Machine (A): Pricing To Capture Value, or Not. Harvard Business Review.

- Kumar, V. (2014) Making "Freemium" Work. Harvard Business Review.

- Levitt, L. (1965) Exploit the Product Life Cycle Case Study. Harvard Business Review.

- Levy, A. (2018). Amazon.com Is Giving Prime Members Some Big Incentives to Shop at Whole Foods. [online] The Motley Fool. Available at: fool.com [Accessed 28 Apr. 2018].

- Liaos, C. (2015) My first [e]book: The Evolution and Dynamics of the Mobile App Economy – Strategies for Innovating and Marketing Mobile Apps. AppGirl.net.

- Lunden, I. (2017). Postmates expands Unlimited, a Prime-style subscription service, to 250k merchants. [online] Available at: techcrunch.com [Accessed 28 Apr. 2018].

- MakeUseOf. (2016). Is YouTube Red Worth the Money? 7 Things You Need to Consider. [online] Available at: makeuseof.com [Accessed 28 Apr. 2018].

- Marn, M., Roegner, E., & Zawada, Craig C. (2003) The power of pricing. McKinsey Quarterly.

- Matthews, C 2014, 'The one price Amazon is willing to raise', Fortune.Com, p. 1, Business Source Ultimate, EBSCOhost, viewed 10 April 2018.

- Medium. (2017). Amazon Prime—A Predatory Pricing Shield – Wesley Walser – Medium. [online] Available at: medium.com [Accessed 29 Apr. 2018] and Sandholm, D. (2014). Amazon's 'predatory pricing' questioned. [online] CNBC. Available at: www.cnbc.com [Accessed 29 Apr. 2018].

- Middleton, C. (2014) Is this the end of the honesty box? The Telegraph.

- Molla, R. (2018). Netflix spends more on content than anyone else on the internet — and many TV networks, too. [online] Available at: recode.net [Accessed 28 Apr. 2018].

- Moon, Y. (2005) Break Free from the Product Life Cycle Case Study. Harvard Business Review.

- Morgan Stanley Research (2017). Amazon Disruption Symposium. Where so Far? Where to Next? Who is safe? [online] Available at: fa.morganstanley.com [Accessed 28 Apr. 2018].

- Music Business Worldwide. n.d. Number of paying Spotify subscribers worldwide from July 2010 to January 2018 (in millions). Statista. Accessed 28 April, 2018. Available from statista.com

- Nagle, T. (2013) The strategy and tactics of pricing a guide to growing more profitably. Fifth edition. Pearson. Chapter 1 'Strategic Pricing', pages 17-32, Chapter 2 'Value Creation', pages 33-54, Chapter 3 'Price Structure', Chapter 10 'Financial Analysis', pages 223-251, Chapter 11 'Competition'

- Netflix.com. (2018). Netflix - Watch TV Shows Online, Watch Movies Online. [online] Available at: netflix.com [Accessed 28 Apr. 2018].

- Rodriguez, A. (2018). Disney’s massive Fox acquisition is all about defeating Netflix. [online] Quartz. Available at: qz.com [Accessed 28 Apr. 2018].

- Russell, N. (2017). Understanding Amazon’s flywheel. [online] Amazonian blog. Available at: amazonianblog.com [Accessed 28 Apr. 2018].

- ShopRunner. (2018). FAQ. [online] Available at: shoprunner.com [Accessed 28 Apr. 2018].

- Sismeiro, C. Angiomax and Medicines Co.. Imperial College Business School.

- Sismeiro, C. Functional Forms for Models with One Intercept and One Variable. Imperial College Business School.

- The Economist (2012) How Fujifilm survived. The Economist.

- The Economist (2012) The last Kodak moment?. The Economist.

- Tsukayama, H. (2018). What Amazon’s learned from a decade of Prime. [online] Washington Post. Available at: washingtonpost.com [Accessed 24 Apr. 2018].

- Tuttle, B. (2018). Amazon Prime: Bigger, More Powerful, More Profitable than Anyone Imagined | TIME.com. [online] TIME.com. Available at: business.time.com [Accessed 26 Apr. 2018].

- U.S. (2018). Amazon says it has more than 100 million Prime members. [online] Available at: reuters.com [Accessed 27 Apr. 2018].

- Walmart.com. (2018). Free Shipping, no membership fee [online] Available at: walmart.com [Accessed 28 Apr. 2018].