From "Food with Integrity" to E.Coli

Understanding Chipotle's strategic challenges in late 2012Chipotle Mexican Grill (CMG) started as a Mexican restaurant chain in the 1990’s, focusing on food quality and the “open kitchen” experience. In 2000, CMG Founder Steve Wells adopted “Food with Integrity”, creating a niche in the fast-casual segment. In parallel, CMG grew rapidly, from 18 restaurants in 1998, to 1316 in 2012, while stock price increased from $45 during the 2006 IPO, to over $300 in 2012, reaching an all-time high at £724 in July 2015. The e. Coli contamination crisis broke out in October 2015, delivering a severe blow to CMG’s credibility, revenue growth and profit margins, with the stock plummeting at the region of £400, where it has remained ever since.

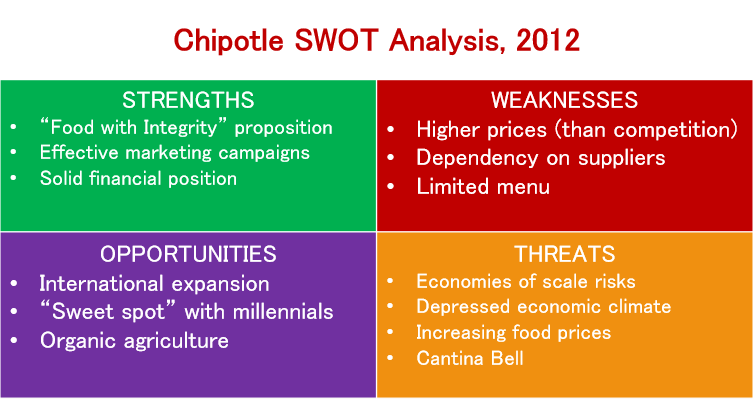

This essay will provide a strategic analysis of CMG, summarizing the CMG story from 1996, and assessing whether CMG can be considered as successful from financial, shareholder and societal points of view. “Food with Integrity” differentiation will be further analyzed to determine the key drivers of CMG’s competitive advantage. Furthermore, the strategic challenges of late 2012 will be analyzed, conducting a SWOT analysis, to determine how CMG should have positioned to respond to known challenges at the time, concluding with two alternative options to boldly re-define CMG’s position towards sustainable growth.

Has CMG been a succesful company and on what basis?

The question of whether CMG can be considered successful (in present day, c. 2017) will be assessed from three points of view:

- growth and profitability

- value delivered for shareholders

- and value for society.

Starting as a startup with a family loan of $80,000, CMG grew to a market cap of $11.9 billion and 64,000 employees in 20125 with a solid record of profitability. Thus, from a growth story perspective, it is fair to state that CMG has been a story of success for many years, at least until the e. Coli outbreak of 2015.

Looking at returns to shareholders, CMG has not historically paid dividends, while P/E ratio was consistently higher than market average, showing that investors favored CMG despite the weak relationship between share price and earnings, due to expectations for growth. After e. Coli, significant shareholder value eroded, wiping off billions of market cap. Overall, shareholder returns have been highly volatile, and heavily dependent on stock price fluctuation.

From a society perspective, the “Food with integrity” mission was integral in positioning CMG as a company in line with society needs, such as sustainability and humane farming with respect to “animals, the environment, and the farmers”. Sustainability programs,such as “local sourcing”, “seasonal produce” and “organic agriculture” further enhanced CMG’s image of positive impact on society.

However, the e. Coli outbreak tarnished CMG’s reputation, raising questions about company practices, doubting the ingenuity of the overall value-driven mission. With CMG stepping back from sustainable practices to manage food safety risks after the scandal, key logical assumptions came into question: “Would you rather eat [real fresh food and] take a chance on getting a case of the shits? Or would you rather have your food precooked and every possible intervention done to [it]?”, as media colorfully reported.

In conclusion, CMG has been a success story, having grown exponentially since 1996. However, value to shareholders has been below market average and highly volatile due to heavy dependency on stock price. “Food with Integrity” has been a compelling strategy for years, positioning CMG as a company that “changed the rules”, adding value to society, but the e. Coli scandal in 2015 has had a devastating effect, not only putting the company’s practices in question, but doubting the overall vision and value proposition;- Can sustainably sourced, fresh food, by a multi-billion corporation that seeks to grow exponentially, be sustainable?

How does CMG differentiate from competition?

“Food with Integrity” is CMG’s mission statement and strategy foundation for competitive advantage. Setting out to challenge fast food trends, CMG received acclaim for disrupting the traditional fast food- industry, with a differentiation strategy at the intersection of qualitative full-service and fast food.

Challenging the common wisdom of reduced prices, longer menus and operational automation for efficiency, CMG went in the opposite direction. Freshly prepared food, top-quality ingredients, premium interiors and minimal menus effectively appealed to a broader audience with a higher willingness to pay for what key competitors sold as fast food.

From a strategy perspective, this approach provided a competitive advantage to CMG, driven mainly by intangible factors, such as aspirational status, exclusivity and brand equity. CMG preferred company owned restaurants over franchise. An innovative setup of smaller size spaces, limited menus and assembly line systems was chosen to achieve operational efficiencies without compromising in food quality.Focusing on energy efficiency, CMG installed solar panels and sought to obtain environmental certifications, consistent with the CMG brand image and mission.

The approach of sustainable ingredients sourcing increased the attachment of CMG with small, independent, family farms, creating dependencies on high quality producers, who could access alternative retail buyers, such as Whole Foods and Trader Joe’s. CMG’s marketing focused on positioning the brand at the premium end of the spectrum, investing on word-of-mouth publicity and loyalty rather than traditional advertising.

“Back to the Start” was designed to strengthen the brand’s transformational effect, moving from industrialized farming, to a more humane sustainable method, while the “cultivate” festival strengthened ties with millennials who CMG considered a “sweet spot” due to their aspiration for healthy eating.

What were the main strategic challenges facing CMG in late 2012?

In late 2012, CMG was facing key challenges, due to competitors’ strategies for offer upgrades and expansion, reversing customer trends, as well as depressed economic climate, and expected increases in food prices.

From a competitor perspective, Taco Bell saw an opportunity in price competion, offering plates which CMG priced at $8, “just as good”, charging less than $5. To exploit this opportunity, the upscale “Cantina Bell” menu was launched, to which Taco Bell attributed 7% same-store sales growth in Q3 2012 (YoY). Thus, CMG was under pressure, especially on the ability to continue to differentiate and attract higher premiums for “Food with Integrity”.

Customer trends were another key challenge for CMG. Per the Einhorn presentation, 23% of CMG customers had already tried Cantina Bell within 4 months of launch, and two-thirds of them where most likely to return, putting CMG at risk of losing frequent customers.

CMG stock fell by over 4% by the end of the day of Einhorn’s presentation, demonstrating the impact of this risk. Furthermore, depressed economic climate presented CMG with additional challenges. Reduced income was bound to increase price sensitivity, favoring cheaper alternatives. Finally, deteriorating cost conditions, because of an expected increase in food costs, would be exacerbated for CMG due to high dependence on a fragmented supplier base.

How should Steven Ells and Montgomery F. Moran position CMG to respond to these challenges?

To determine how CMG should respond to the above challenges, a SWOT analysis will be conducted. Recommendations will then be made, focusing on a key decision point for CMG in 2012.

Table 1, CMG SWOT 2012

Strengths

The “Food with Integrity” proposition provided a significant competitive advantage. The brand’s alternative appeal was compelling for key segments of consumers generating competitive advantage with strong, but mostly intangible, elements. Marketing campaigns, focused on alternative channels and word-of-mouth, were highly effective in augmenting brand value.

Weaknesses

High prices were a key weakness for CMG, as competitors were enhancing their menu to offer similar products in significantly cheaper prices. A chicken Burrito was 64% more expensive in CMG compared to Cantina Bell and a steak Burrito 72%. High dependency on several, small suppliers was a drawback of sustainable sourcing. Additionally, menu limitations influenced the choice of variety-seeking customers.

Opportunities

Given the successful record of growth, CMG could shift focus abroad, replicating its model abroad to new markets. Opportunity could also arise from the “sweet spot” with millennials, creating potential for

diversification, leveraging their existing sustainable farming supplier network. Organic agriculture could

help CMG further upscaling their offer instead of fighting in the red ocean of mainstream competition.

Threats

As CMG grew, significance of economies of scale increased, applying pressure to operations, from logistics to purchasing and advertising, while “Food with Integrity” did not position CMG well to achieve efficiencies without stretching its limits. Depressed economic climate and expected increases in food prices posed threats to CMG margins from revenue and costs standpoints respectively. Finally, Cantina Bell, positioned as identical to CMG at lower cost, posed a threat to CMG’s ability to maintain differentiation and competitive advantage in the eyes of consumers.

Conclusion

In conclusion, most of the SWOT key points, positive or negative, are effects of the central “Food with Integrity” value proposition.

Thus, a central dilemma for CMG in 2012,should have been whether to focus on efficient growth, stepping back from “Food with Integrity”, or strengthening “Food with Integrity”, stepping back from continuous growth (in existing business).

The first option would require catching up with competition, scaling back in areas such as ingredients’ sourcing, food preparation, while considering menu expansions and price promotion. The effectiveness of “Food with Integrity” would probably be reduced, but CMG would position for scale and set-up for further growth in the long run.

Alternatively, CMG could focus on solidifying “Food with Integrity” through transformation for sustainability, while setting expectations that continued fast growth and short-term returns should not be expected. This approach could include diversification (e.g. to leverage the “sweet spot” with millennials) or a move to new segments (e.g. upscale “organic” Mexican restaurant) or to some form of backwards integration to reduce costs and solidify quality.

Whatever the choice, what CMG really needed was a bold decision which involved sacrifice, avoiding a watered-down, tactical approach (e.g. increasing prices and opening new restaurants) which delivered short-term gains, but at the cost of further exposing CMG to existential risks, such as the ones that materialized in 2015 when the e. Coli outbreak struck a severe (and perhaps irreparable) blow.

References

- Subramanian R. (2013), Chipotle Mexican Grill Inc. Food with Integrity, Ivey Publishing, W13231

- Team T. (2015), Stock Touches All-Time High, As Chipotle Fills In The Gaps, Forbes [online], available at: https://www.forbes.com/sites/greatspeculations/2015/07/27/stock-touches-all-time-high-as-chipotle-fills-in-the-gaps/#5f69d22e22ee, accessed 10 Jul. 2017.

- Morningstar (2017), CMG Chipotle Mexican Grill Inc Stock Quote, Morningstar [online], available at:

http://www.morningstar.com/stocks/XNYS/CMG/quote.html, accessed 10 Jul. 2017. - Wikinvest (2017), Stock: CMG Mexican Grill (CMG)/Dividend Policy, wikinvest.com [online], available at: http://www.wikinvest.com/stock/CMG_Mexican_Grill_(CMG)/Dividend_Policy, accessed 10 Jul. 2017.

- Carr A. (2017), Chipotle Eats Itself, Fast Company [online], available at: https://www.fastcompany.com/3064068/chipotle-eats-itself, accessed 10 Jul. 2017.